Latest Posts

Ora sappiamo che è possibile contrarre la malattia se si viene morsi da una zecca. Ma poiché non deve essere sempre unilaterale, la domanda ora è: ti ammali ...

La squadra di baseball U15 dell'Alcmaria Victrix potrà brillare nel Torneo Baseball di Sala Baganza Anche i giocatori di baseball e le loro ...

Gli scienziati hanno finalmente trovato prove convincenti che possono datare con precisione l’età del campo magnetico terrestre. Non solo quello; Le stesse ...

Agenzia di stampa franceseIl ministro iraniano Ahmed Vahidi, che si dice abbia ordinato l'attaccoNoos Notizie•Oggi alle 15:14Il governo argentino vuole ...

L’Italia era un tempo il centro del primo impero europeo e la culla del Rinascimento. Le influenze politiche e culturali italiane si diffusero ...

Che chi lo indossa sia reale o meno, se il vento colpisce il cappello, deve averlo. Questo pomeriggio anche il cappello di Maxima era sparito. Questo ...

Anche se Elzinga ha lavorato per ASTRON solo per un anno e mezzo, negli ultimi anni ha raccolto molte immagini. Venne a lavorare a Dwingeloo, ma gli piacque ...

L'allenatore dell'Ajax John van't Schip tornerà al sistema di gioco con quattro difensori nella partita contro l'Excelsior di mercoledì sera. ...

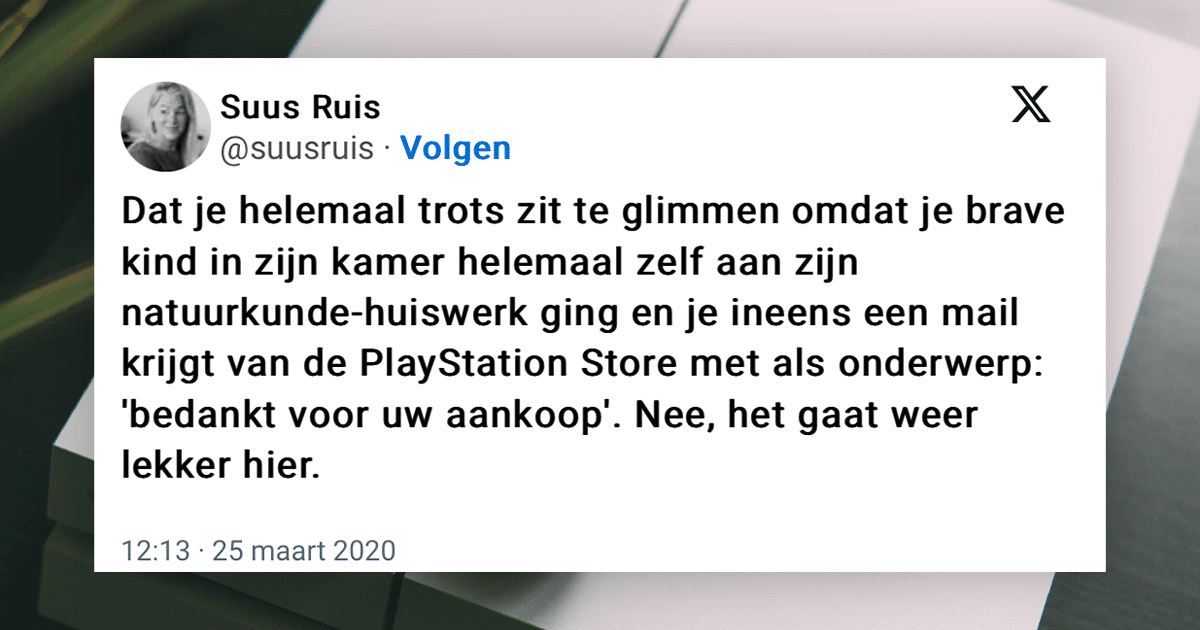

casa » Cartelle di lavoro » Inizio partita! Quale console di gioco è giusta per te?Dalle serate nostalgiche con Nintendo alle epiche battaglie su PlayStation. ...

Agenzia di stampa franceseLeader del partito Alternativa per la Germania Maximilian KrahNoos Notizie•Oggi alle 11:30Il deputato del Parlamento europeo ...